Achieving your dream of home ownership in Australia is within reach with the assistance of a private home loan. These loans offer unique financing options that can help you bypass traditional lending standards. Private lenders often provide quicker approval read more times and evaluate applications based on individual circumstances, making them a viable solution for those who may not qualify for conventional mortgages. With a private home loan, you can tap into the opportunity to own your dream property, even if you face challenges with credit history or earnings.

- Private lenders offer tailored solutions that meet individual needs.

- Faster approval processes compared to traditional banks.

- Greater flexibility in terms of loan agreements.

Hoping of Homeownership? Bad Credit? No Problem! Private Home Loans Available

Worried about your credit history stopping you from achieving your homeownership aspirations? Don't fret! We provide a alternative with private home loans. These flexible finances are designed specifically for individuals with less-than-perfect credit, supporting you secure the capital you need to make your dream home a reality. We understand that everyone's circumstances is unique, and our dedicated team will work with you every step of the way to find the perfect loan solution.

- Apply today and let us help you unlock the door to homeownership!

- Don't let bad credit hold you back any longer.

- We're ready to guide you through the process.

Non-Bank Private Home Loans: A Pathway to Homeownership for All

Achieving the dream of homeownership can sometimes feel like a distant goal, particularly in today's competitive real estate market. Traditional mortgage lenders often have stringent standards that can exclude many qualified borrowers. However, there is an emerging solution gaining popularity: non-bank private home loans.

These financing options are provided by independent lenders who offer more lenient criteria. This can be a lifesaver for buyerswho need alternative lending options.

Non-bank private home loans offer several benefits over traditional mortgages. They often have shorter underwriting periods, allowing homebuyers to move quickly. Additionally, they can be more flexible towards borrowers with non-traditional income sources.

- In addition| Non-bank private home loans can often provide access to financing for investment properties.

- Consequently| These loans are helping to expand the pool of eligible homebuyers, making the dream of homeownership more attainable for a wider range of individuals.

Unlocking Property Potential: Private Home Loans for Australians

Navigating the real estate market can be challenging, especially when traditional lending options fall short. Non-conforming home loans present a compelling solution, empowering individuals to achieve their property dreams even with unique financial situations. These tailored loan products offer attractive interest rates and relaxed lending criteria, making them a viable option for those seeking non-standard financing solutions.

These type of loan allows individuals to access their property's equity for renovations, investment purposes, or even debt consolidation.

Understanding the benefits and disadvantages of private home loans is crucial before making a strategic decision. Consulting with a reputable broker can provide valuable insights and guidance throughout the process.

Unlocking Fast & Flexible Financing: Discover the Benefits of Private Home Loans

Private home loans offer a innovative approach to securing funds for your dream house. Unlike traditional financing options, private loans often provide faster approval times, allowing you to swiftly move forward with your purchase. This flexibility is highly valuable in today's shifting real estate market, where time is of the essence.

Furthermore, private lenders are recognized as their adaptability. They often accommodate a wider range of borrowers, including those who may not meet the criteria for conventional mortgages.

You can explore a variety of loan options to find the best solution for your individual circumstances.

This tailored approach can result in more beneficial interest rates and agreements compared to traditional financing.

When considering a private home loan, it is important to thoroughly investigate different lenders and compare their products. Be sure to understand the conditions of any loan agreement before committing.

Looking |of| Traditional Lenders? Uncover |Private Home Loan Solutions|

Are you discouraged by the demanding requirements of conventional lenders? Do you desire a more flexible approach to your home financing? If so, it's high time to step outside the traditional mold.

Non-bank private home loan institutions offer a unique solution for borrowers who can't qualify for standard financing. Such products often come with relaxed conditions, and a broader willingness to work with borrowers who have specific financial situations.

- Research private lenders if you:

- Possess a credit history

- Are self-employed

- Incorporate rental income

- Desire a faster approval process

Jenna Jameson Then & Now!

Jenna Jameson Then & Now! Joshua Jackson Then & Now!

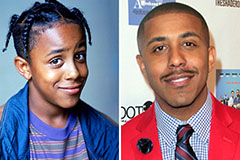

Joshua Jackson Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Phoebe Cates Then & Now!

Phoebe Cates Then & Now! Traci Lords Then & Now!

Traci Lords Then & Now!